best stocks to sell covered calls reddit

It is now 70. In theory on the day a company pays a dividend the stock should trade lower by the amount of the dividend because.

Watchlist Of 80 Stocks For Selling Puts Wheeling R Thetagang

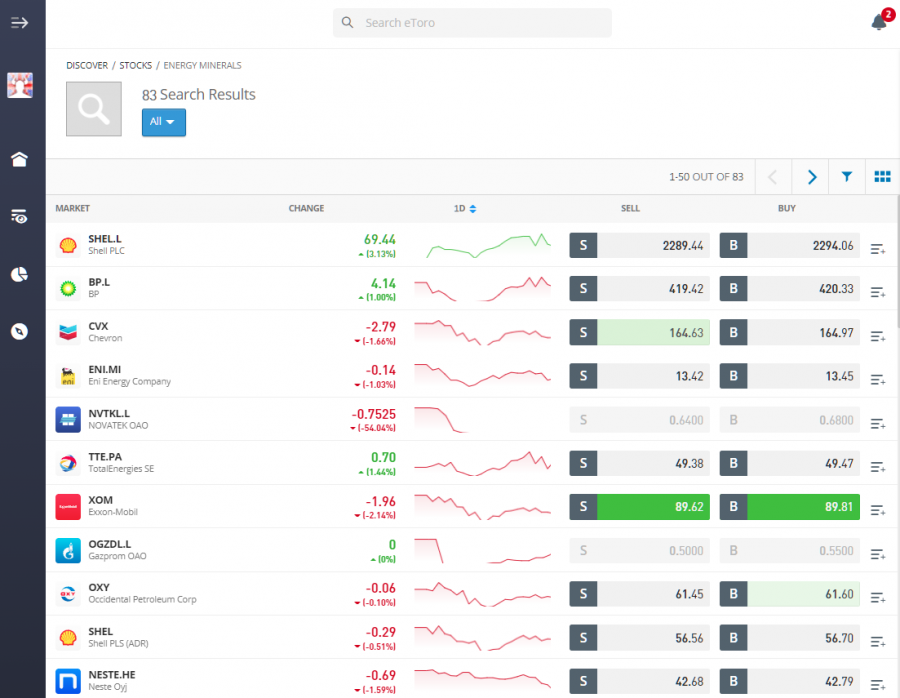

Despite a move from under 85 to 98 in the past 3 weeks XOM options arent pricing that sort of move.

. But you should be aware that dividends do play a role in call option pricing. 10 Buy-Write Rules to Follow. MCD closed at 160 on Wednesday.

The deep in-the-money 4400 strike has a Delta of 09476 while the deep out-of-the-money 6600 strike has a low Delta of 0012. That means Best Buy stock could trade 253 lower between now and Nov. The Best Covered Call Stock.

128 call for a net debit of 495. Suppose today June 3 2022 the SPY Trades at 41658. 120 call while selling the Aug.

For a free trial to the best trading community on the planet and Tylers current home. The 105 January calls are trading over 2 so selling against 13 of a position would get you about 67 against the full. Investors using the covered call option trading strategy own the underlying stock and sell one call option for every 100 shares held.

This means you will have an unrealized loss of. You could sell the 23 March 160 covered calls for 355 at last check. To build the covered call you need to buy the stock in increments of 100 shares.

If shares trade at 23 and you sell a 3 month call with a 25 strike for 075 you still make 275 on a 23 stock when you are. Exxon Mobil started 2022 near 60 and is now approaching an all-time high near 100. AGTC is what Ive been using.

When you sell or write a covered call contract youre selling someone else the option to buy 100 shares of a stock you already own at a predetermined price. Ad Free Strategy Guide reveals a simple powerful secret for extra income. A covered call is an options strategy in which the trader holds a long stock position and sells a call option on the same stock in an attempt to generate income.

You might sell three of the 23 Feb 44 naked puts for 130 each. One positive of the declining stock price is a very tasty pardon the pun dividend yield which currently sits at 432. The 280 in premium received also gives a small buffer on the downside of 253.

I love this sale because it earns almost 3 and thats. Walmarts stock price never closed below triple digits and demonstrated good support ahead of the psychological 100 level that can help protect a covered call position. 775 266 the premium for the call 509 net loss.

If you are concerned about being put into a position just sell OTM. There are many factors in choosing a. Then you sell 1.

Im long on the stock and holding 600 shares selling covered monthly calls. 100 buy rating with an average 22 target currently trading around 530. This can be done individually or it can be done simultaneously with the selling of the call.

On the stock youll have a 14775 140 775 loss per share. Determine the parameters you want to put on your transaction. Selling Covered Calls.

Discover our trading course that shows how to earn extra income trading options. When traders make a case for selling long-term options against their stock positions they usually argue that the long-term. I like the idea of selling covered calls in order to add extra profit besides the stock price itself.

KHC KraftHeinz Dividend Growth Stock Chart. If some gets called away at 105 its been a heckuva run. You get a 222 premium and keep it if it isnt called away.

INTC Option Chain with Delta Stats. Hard to answer what the best stock for the best premium is because that would be the stock with the highest premium that always closes just below your covered call strike crystal ball. You would collect 390 bringing your total to 770.

The Feeble Argument for Long-Term Covered Calls. For example OXY was a 10 stock in Summer 2020 and a 28 stock to start 2022. Im searching for stocks with upwards potential for the future preferably quite some volatillity higher option prices and not to high share price pref.

You buy 100 shares of the SPY for a total outlay of 4165800. First and foremost you need to do your own research and pick a company that you like enough to want to hold their stock. 20 and the covered call trade.

When you sell a covered call option youre agreeing to sell your stock on demand for a set price the strike price for a.

How To Day Trade Stocks In June 2022

2 Strong Stocks To Watch Monday R Options

10 Most Shorted Stocks Hedge Funds Are Buying

Dylan Jovine Takeover Targets Review 2022 Are These Buyout Stocks Legit In 2022 Capital Partners How To Find Out Value Investing

The 3 Most Shorted Stocks To Buy Right Now

How To Day Trade Stocks In June 2022

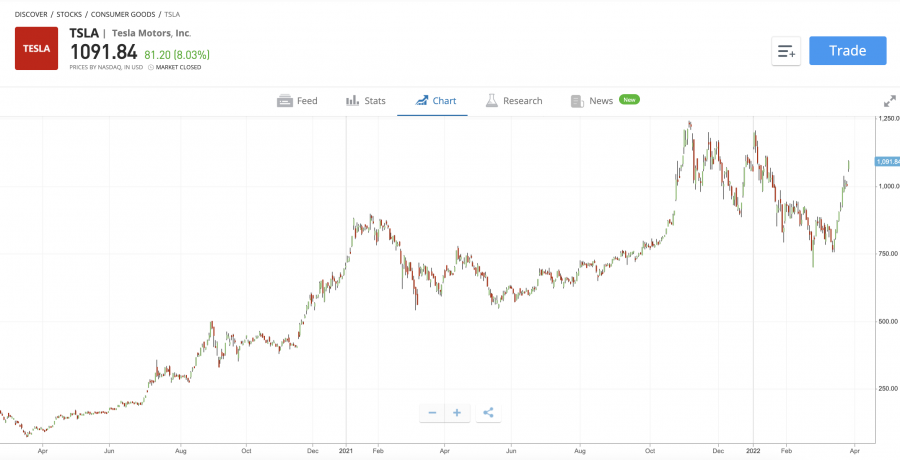

How To Buy Tesla Stock In 2022 With 0 Commissions

Stock Market Psychology 101 Market Emotion Cycle Greed Fear Cycle Save For Future Reference Infographics Greed Psychology Psychology 101

How To Day Trade Stocks In June 2022

Best Stocks For Covered Calls In 2022

/BeginnersGuidetoCallBuying-6d00c8bc193a43b6b45c6347f2bd50d1.png)

A Beginner S Guide To Call Buying

Rate My Portfolio R Stocks Quarterly Thread June 2021 R Stocks

How To Day Trade Stocks In June 2022

Best Covered Call Stocks R Options

/BeginnersGuidetoCallBuying-6d00c8bc193a43b6b45c6347f2bd50d1.png)

A Beginner S Guide To Call Buying

How To Day Trade Stocks In June 2022

Rate My Portfolio R Stocks Quarterly Thread December 2021 R Stocks